What Sets Us Apart

At Bradley Nuttall, we specialise in providing comprehensive wealth management and investment advice services to clients across Christchurch, Tasman, Marlborough, Nelson, Canterbury, and overseas.

If you’ve suddenly gained wealth, are seeking better investment performance, are planning for retirement, or are aiming to secure your family’s future, Bradley Nuttall advisers are here to help.

Additionally, our specialist advice areas include pension transfers, investor visas, and advice for high-net-worth individuals.

Our Financial Advice Services

We deliver

value to our

clients through:

Performance

We provide you with confidence that, no matter what happens in the markets, the economy, or the world, you are highly likely to achieve your most important life goals.

Personalized services

Our relationships are built on understanding financial goals and lifestyle aspirations. Financial advisors in Christchurch or Nelson will ensure our service is tailored to you and your situation.

Specialty Areas of Advice

High Net Worth

Often high net worth individuals and families have multiple investments across a range of asset classes. Considering these in isolation is not efficient and can lead to unexpected exposure to risks.

Investment Visa

If you are applying for a New Zealand visa that requires investments, we can help structure your investment portfolio. The Active Investor Plus Visa requires an investment of NZD 15 million across…

Investment Consultant

If you’re acting as a trustee, it can be prudent to seek expertise to help with your investment decisions or obtain a second opinion. This could be regular investment updates or creating a Statement…

Pension Transfer

Transferring a pension to New Zealand can be a complex process, involving potential tax implications in both countries and the consideration of various pension benefits.

What Our Clients Say

![]()

Bradley Nuttall have been my financial advisers in Christchurch and investment planning specialists for the last five years. During this time, I have been impressed and delighted with all aspects of their work.

Their customer service orientation is exemplary. They are easily accessible and can communicate the more complex nature of investing to a layperson in plain English. No question is off-limits, and they always take it seriously.

They visit in person each year. Because of this, my understanding of financial investment has grown substantially, which has meant I’m more informed and confident about the investment decisions I make.

The investing methods and criteria they use to inform their investment work are their own and backed by ongoing evidence over time.

Because of their intelligent and robust approach, I trust them fully. This greatly comforts an investor, especially during a pandemic and a global financial crisis.

Being a client of Bradley Nuttall means a tremendous amount to me. I know my investment is in safe and thoughtful hands, that I will be kept regularly informed about my portfolio, that I can ask questions at any time and be taken seriously, and that my needs for my financial future are carefully and respectfully made possible.

Chris

Christchurch

![]()

Bradley Nuttall runs a very professional financial advisory and investment service. Their advice is designed to fit our present financial needs and goals. They keep in touch frequently and recommend any changes to us before acting on them.

We feel we have a professional advisor/ client relationship that constantly evaluates where our portfolio is at. I recommend they invest money wisely and safely and then look after it for you.

Alan and Lorraine

View Our

Latest Updates

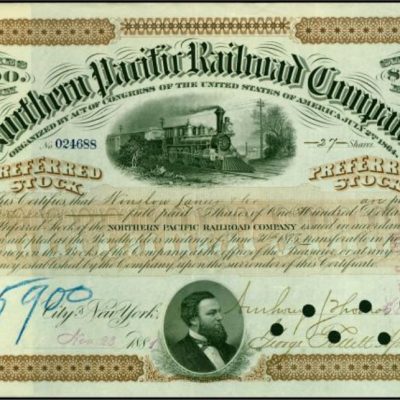

Lessons from The Rise and Fall of 19th-Century Railroad Companies

In the 1800s, the American railroad industry was one of […]

Key Market Movements for Q4 2025

The final quarter of 2025 delivered steady gains, with several […]

Investment Market Review Summer 2026

Investment Market Review Following a volatile but generally profitable first […]

Our Financial

Planning Approach

Achieving financial freedom and financial stability is more than simply investing funds successfully. An independent adviser ensures that you have a financial plan to give you a secure future and provides the framework to monitor plans while potentially planning for the next generation.

“Achieving your financial goals is our ultimate success.”

What is Financial Advice?

Financial advice is professional guidance provided by a qualified and licensed firm to help you make confident, informed decisions about your money and your future. It covers a wide range of areas, including investment planning, retirement planning, tax planning, estate planning, personal insurance, and cash-flow management. At Bradley Nuttall, our financial advisers in Christchurch and Nelson specialise in investment advice, financial and retirement planning, and KiwiSaver, helping you build clarity, confidence, and long-term financial security.

What should I consider when choosing a financial adviser?

Choosing the right financial adviser is an important decision. A good adviser should not only be qualified, but also experienced, independent, and transparent in how they operate. Key things to consider include:

Licensed Advice Provider

Ensure the adviser or firm is licensed by the Financial Markets Authority (FMA). This confirms they meet New Zealand’s regulatory standards and operate under appropriate professional and compliance requirements. You can verify this through the Financial Services Provider Register (FSPR).

Experience and Qualifications

Look for advisers with strong professional qualifications and substantial industry experience. For investment advice, a long track record (preferably greater than 20 years) in financial markets is especially important. Experience through different market cycles provides valuable insight and perspective. You can view our experienced team to learn more about our advisers’ backgrounds.

Independence

Independent advisers are not tied to any specific product providers. This means their advice is based solely on what is best for you, not on commissions or sales incentives. Independence helps ensure recommendations are objective, transparent, and client-focused.

Fees and Transparency

Understand how the adviser is paid and ensure their fee structure is clear, fair, and aligned with your needs and budget. Transparent fees allow you to see exactly what you are paying for and how the advice adds value.

Together, these factors help ensure you receive advice that is professional, unbiased, and truly focused on your long-term financial wellbeing.

How much will a financial advisor cost?

We are a fee-only firm. This means we do not receive commissions or incentives from product providers and are paid solely by our clients. As a result, you can be confident that our advice is independent and always focused on what is best for you.

All fees are fully disclosed in advance, so you know exactly what to expect before any work begins. There are no hidden costs or surprises.

As financial advisers in Christchurch and Nelson, our approach is to build long-term relationships with our clients. Our fee structure reflects this, with low initial fees for investment and financial planning, and competitive ongoing fees for investment management and advice.

Full details of our fees are available in our Disclosure Statement.

Wealth management

Wealth management

Retirement Planning

Retirement Planning

Specialty Advice Areas

Specialty Advice Areas