FINANCIAL PLANNING

Goal setting is important

Financial Modelling

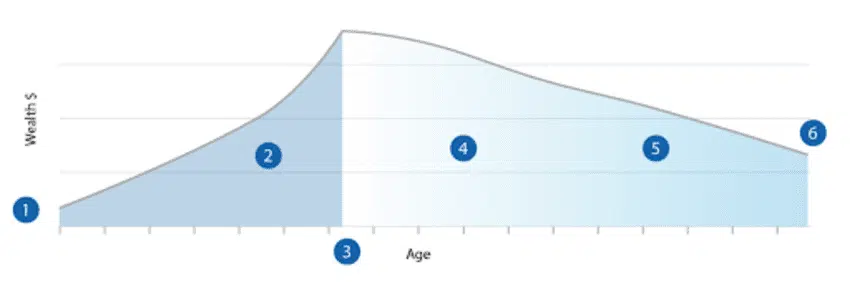

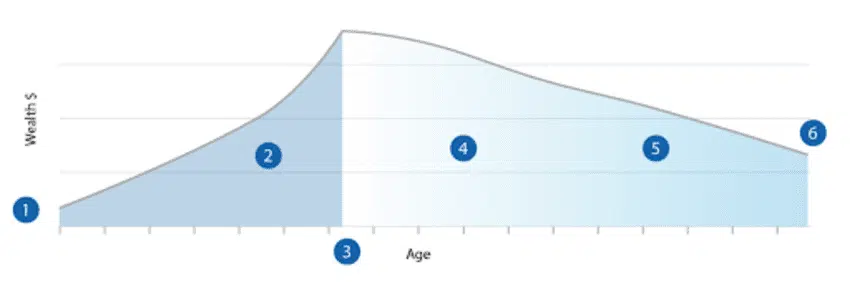

Our financial model will forecast cashflows into the future given what we know today. This includes a range of different scenarios based on a) decisions that you may make in the future or b) your risk appetite. The modelling will incorporate your annual income and expenses and any significant expected costs at different stages of your life. The three main stages to consider are:

Accumulation stage

During this stage you are still building your wealth. The main drivers are usually regular savings and growth from investments but can be due to inheritance or other large one-off payments. The amount you accumulate in this stage will determine how much financial freedom you have in retirement. The growth rate of your investments will be determined by the specific characteristics of your portfolio.

Active Retirement

These are the years where you enjoy the lifestyle you want to have in retirement. Maybe that is travelling around the world, spending time with family, spending time on the golf course, helping in the community or any other hobby or activity. During these years you are normally using money from the portfolio to help fund this lifestyle

Less active retirement

There comes a point where you become less active and your hobbies and activities are closer to home. Often lifestyle expenses decline during this stage but there may be health related expenses we need to plan for. You are likely to reduce risk in your portfolio during this stage as the investment horizon decreases.

The chart below shows a generalised diagram of some of the considerations for your financial modelling.

- Your initial investment wealth.

- Accumulation stage

- Retirement age

- Active Retirement

- Less Active Retirement

- The estate you pass on to the next generation.

HOLISTIC FINANCIAL PLANNING

A holistic financial plan will consider other important aspects which impact on your finances outside of your investments. This includes estate planning, risk and asset protection, intergenerational wealth transfer, and other investment assets.

Every client’s situation is different and a financial plan will be tailored to your specific situation and what you are looking to achieve. Contact one of our advisers to find out more about our financial plans.