WEALTH MANAGEMENT CHRISTCHURCH & NELSON

INVESTMENT SERVICES

OUR PROCESS

Bradley Nuttall financial advisers recognize the importance of a thoughtful and systematic approach to investment and financial planning. Our advice process is crafted to ensure that your financial goals are not only met but are achieved in a manner uniquely tailored to your specific situation.

INVESTMENT PHILOSOPHY

Our evidence based investment philosophy serves as the guiding principle that shapes our approach to making investment decisions and managing clients portfolio.

CONSULTANCY SERVICES

We provide a comprehensive range of consultancy services particularly for Trustees who are seeking a second opinion on a range of matters relating to investment under their care. Such services include drafting Statements of Investment Policy as well as undertaking KiwiSaver reviews.

PENSION TRANSFERS

Transferring a UK pension to New Zealand can be a complex process involving tax implications in both countries. We help our clients by evaluating the benefits and drawbacks of a pension transfer.

CONSULTANCY SERVICES

We provide a comprehensive range of consultancy services particularly for Trustees who are seeking a second opinion on a range of matters relating to investment under their care. Such services include drafting Statements of Investment Policy as well as undertaking KiwiSaver reviews.

REVIEWING AND MONITORING

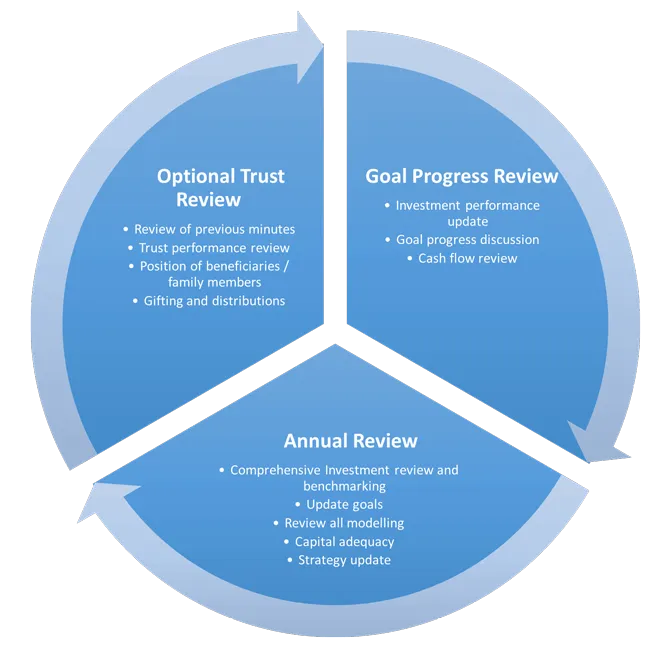

“A plan is worthless unless you review it on a regular basis.” We follow a regular planning review cycle that aligns with client determined requirements and situations. Essentially it comprises two or three steps which may be consolidated into one or two meetings a year or as the need arises”.

PLANNING APPROACH

Without a plan, investors commonly construct their portfolios from the bottom up, paying more attention to choosing and buying investment products than to the process of achieving their goals. Investors without a plan often construct their portfolios by evaluating the merits of each investment individually. If the evaluation is positive, they add the investment to their portfolio, often without considering whether it fits. This process can lead to a mismatch between the portfolio and its objectives. Common, avoidable mistakes include performance chasing and market timing.

Clearly articulating ones circumstances and objectives in one concise document has many important benefits including:

Helps provide long term discipline in investment decision making

- A well-constructed plan helps ensure that rational analysis is the basis for investment decisions, rather than basing those decisions on emotion.

Encourages effective communication

- Because it clarifies the issues most important to you and the investment approach and strategy to be used, it minimises any misunderstandings that may arise.

Allows us to accurately review your circumstances as they change over time

- Such evaluations may indicate that changes to your Financial Plan are warranted.

The Financial Plan provides the foundation for wealth management, where we can address your investment requirements, along with any financial challenges you may face beyond your investments.

“From our perspective a great planning document is a meeting of minds.”

Lynette Johns

INVESTMENT PHILOSPHY

Some key portfolio management considerations

01

Core Investment philosophy – Shares

Our methodology adopts innovations in financial markets research which has spanned the last fifty years.

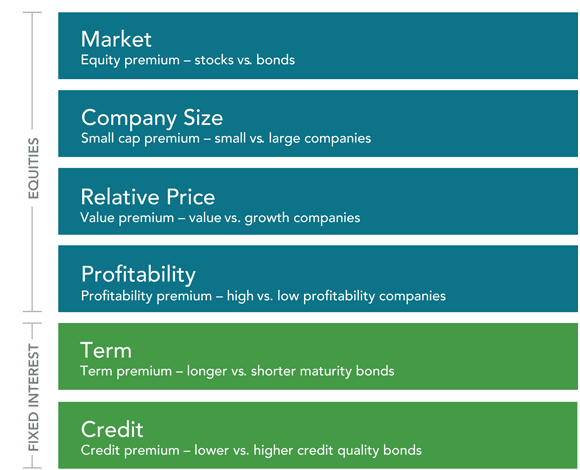

Ken French and Eugene Fama more recently have lead academic research in financial markets, identifying that there are equity and fixed income dimensions that have a higher probability of higher expected returns.

Their research conclusively showed that:

- Small companies consistently outperform large Companies

- Value companies consistently outperform growth Companies

These dimensions are pervasive, persistent, and robust and can be pursued in a cost-effective manner. This outperformance is generally explained by the excess risk that value and small-cap companies face as a result of their higher cost of capital and greater business risk.

What It Means for Investors

Fama and French were quick to point out that while long run returns will be higher by investing in small and value companies, investors need to be prepared to ride out the extra short-term volatility and periodic underperformance that may occur in a given short-term time frame. Investors with a long-term time horizons of 10 to 15 years or more will be rewarded for any discomfort that they might suffer in the short term.Fama-French conducted studies to test their model, using thousands of random stock portfolios, they found that when size and value factors are combined with the beta factor, they could then explain as much as 95% of the return in a diversified stock portfolio.

02

Core Investment philosophy – Fixed Interest

- For longer duration term fixed interest funds, additional returns are generated by trading where the yield curve is steepest. To minimise trading costs, investments traded are essentially Sovereign debt or similar.

- Where credit risk is taken “real time” market credit assessment techniques are employed and the minimum credit rating held is “investment grade”.

Costs are important

Our portfolio fees are low attributed to having direct access to institutional fund managers, holding direct shares in some sectors and rebating all fee reductions to our clients where negotiated.

Tax Management

Tax is another cost that needs to be managed on an ongoing basis. Whether our clients are local or overseas we ensure that the most tax effective structures are employed.

Financial Framework

Our financial planning review process provides the financial framework for clients to quantify and consider the implications of financial decisions made today, in relation to saving or spending. Our best practice processes enable clients to make informed financial decisions today, in confidence for the future

REVIEWING AND MONITORING

“A plan is worthless unless you review it on a regular basis.”

We follow a regular planning review cycle that aligns with client determined requirements and situations. Essentially it comprises two or three steps which may be consolidated into one or two meetings a year or as the need arises.