By Katrina

For anyone who travels overseas, they will understand the pain of significant transactions and foreign exchange costs when using a NZ bank card to take out money from a foreign ATM or make an international payment.

For anyone who travels overseas, they will understand the pain of significant transactions and foreign exchange costs when using a NZ bank card to take out money from a foreign ATM or make an international payment.

Often, there are undisclosed fees, and currency is converted at a poor exchange rate. Recently, we travelled to Europe from New Zealand for a few weeks, and during this time, we needed money in Australia (AUD), London (GBP), and the Euro. For this trip, we tried out using a Wise card for the first time, which made converting money, as required, a simple and cost-effective process.

What is Wise?

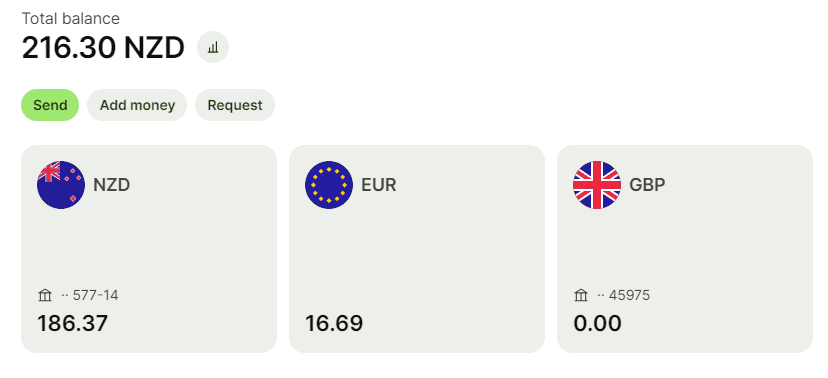

Wise is a UK-based company that provides services to move money around the world in an easy and cost-effective manner. A Wise account provides a more transparent and cost-effective approach to exchanging money into different currencies compared with most banks. You can use Wise via an app to transfer money directly to an overseas bank account, or via a debit card, which can be used as a multi-currency card while overseas.

Setting it up

We set up a Wise account online (https://wise.com/nz/card/) and needed to verify our identities using a passport and address verification (this was all completed online). A card was sent by mail about a week later, and we were able to load money onto the card immediately via the Wise App on our phones. There were no fees to open the account, and a nominal amount to pay for the card of NZD $14. Finally, we connected our New Zealand bank account so we could easily load money onto our NZD Wise account while we were overseas.

How did the Wise card work in practice?

While we were travelling, we were able to use the card to withdraw cash from ATMs (cash withdrawals are limited to twice a month for free, with an upper withdrawal limit of $350 per month before you are charged 1. 5% per withdrawal). We tended not to use a lot of cash, as most places we travelled to accepted cards.

The main benefit of the Wise card was as a debit card in ops or restaurants. There was no transaction fee as long as we held the correct currency in our Wise Account. If we didn’t have the correct currency loaded, Wise would automatically convert to the correct currency from the currency balance held in the account at a low cost. Typically, this was the mid-market foreign exchange rate and their transaction fee (we calculated this to be around 0.33%). It was also possible to move money around in the app, in real time, to ensure we had enough of the required currency for a transaction in-store.

To top up funds onto our Wise account, we could transfer from our NZ bank account (we did this while eating at a restaurant in Paris, and the funds were ready to pay in Euros at the end of the meal!). Finally, the Wise card ended up being a lifesaver when my NZ credit/debit card needed to be cancelled while we were travelling due to card cloning – luckily, I had the Wise card as an additional and primary way to pay for our purchases.

Benefits

- One of the advantages of using a Wise card was that we could very quickly load it up with the currency required from our NZ bank account, and the card automatically drew money from the currency needed in the country we were in, or it could set up to convert money into the required currency with a very competitive exchange rate.

- We avoided some of the significant currency conversion and card transaction costs that are passed on from most banks. Moneyhub has a good article on charges for foreign currency transactions, with most incurring 1%-3% per transaction.

- We only loaded money onto our Wise account every couple of days, so there was never too much money available at any one time (there are plenty of tourist scams, so this helped protect us while in foreign countries).

- The Wise card has been designed with safety in mind. You can receive instant notifications in the Wise app showing when a transaction is processed. You can also review your account any time, and freeze or unfreeze your card within the app.

We will use the Wise card for future trips.

We have concluded that using Wise is a better way to travel when needing to use multiple currencies. It was convenient and safe, and gave us peace of mind that we could spend in euros, pounds, or any other major currencies and get competitive exchange rates every time we needed to switch fr m one currency to another. We could keep a track of our spending and didn’t need to worry about dynamic currency conversion rates. We would recommend this to others as a travel tip!

**Disclaimer:** The views and opinions expressed in this article are solely those of the author and do not constitute recommendations or advice from Bradley Nuttall. Additionally, they may not accurately reflect the services provided by Wise.