The recent fires in Los Angeles and the subsequent loss of housing serves as a reminder to us all that disasters can come at any time. It has been concerning to see that there is a significant number of Californians who are underinsured.

The recent fires in Los Angeles and the subsequent loss of housing serves as a reminder to us all that disasters can come at any time. It has been concerning to see that there is a significant number of Californians who are underinsured.

California insurance market

California’s underinsurance crisis has stemmed from two key factors: (1) previous legislation that prevented insurers from accurately pricing risk and (2) an increase in these risks driven by climate change and urban sprawl. Together, these issues have created significant challenges for homeowners seeking adequate insurance coverage.

In 1988, Proposition 103 reshaped California’s insurance regulatory framework. One of its effects was to prevent insurers from using forward-looking projections to assess risks accurately. Instead, they were required to base their risk models on historical data. As climate change intensified and urban development expanded into fire-prone areas, the likelihood of wildfires grew, making historical data insufficient for pricing future risks. Faced with the inability to price risk accurately and manage escalating exposures, many insurers chose to withdraw from the California market, leaving homeowners with limited options. This has forced many to go without insurance or to turn to the FAIR Plan, California’s insurer of last resort.

In the Pacific Palisades alone, the number of FAIR Plan policies increased by 85% between 2023 and 2024. While the FAIR Plan offers a safety net, it has significant limitations. It is often prohibitively expensive for households and caps payouts at $3 million, leaving many underinsured for the true value of their homes and assets. As a result, numerous Los Angeles households face inadequate coverage. The broader financial and social consequences of this underinsurance will likely become evident in the coming years, particularly as the region continues to grapple with escalating wildfire risks.

Lessons learnt

As a homeowner, it is essential to have proper insurance coverage for your property. One of the most important aspects of home insurance is ensuring that your policy fully covers the cost of replacing your home in the event of a disaster. The Los Angeles wildfires, floods in Gisborne and earthquakes in Christchurch should all be reminders that insurance is an important part of home ownership.

Home replacement insurance provides protection in the event of a loss to your home due to fire, flood, earthquake or other natural disasters, or other unforeseen events. Without this coverage a homeowner can face significant financial losses in trying to rebuild their home to the same specifications.

Changes in residential building costs

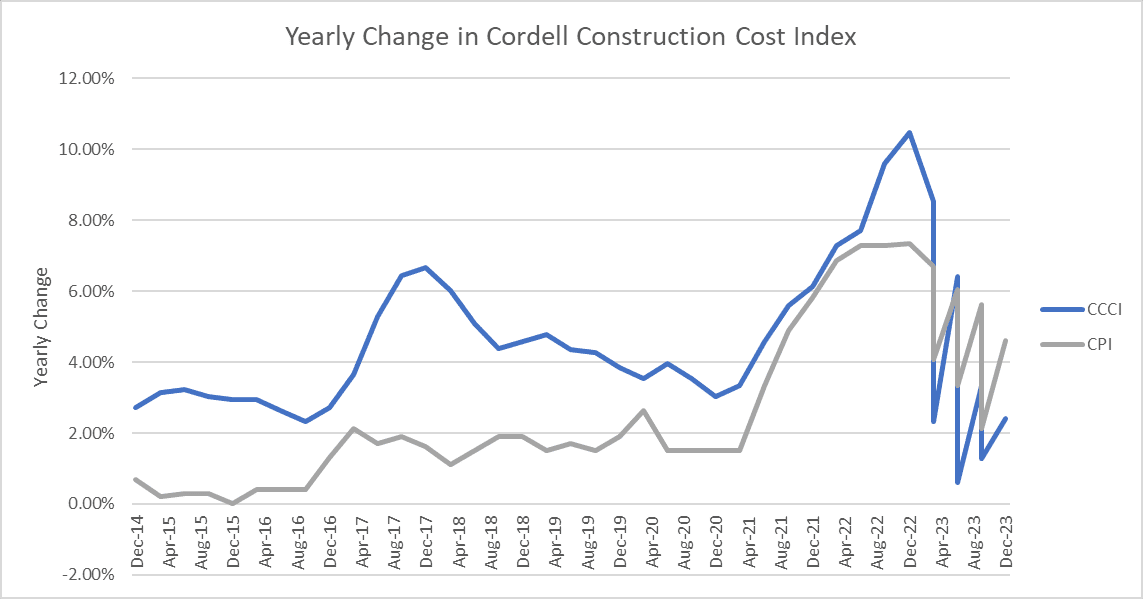

Residential building costs have increased significantly in the last few years, generally increasing faster than inflation, except in the last 2 years. As a result, your homes replacement cost is likely to have increased. The below chart shows yearly changes in the Cordell Construction Cost Index (CCCI) versus the Consumer Price Index (CPI). The CCCI measures the cost of building a standard brick and tile three-bedroom, two bathroom house.

In September 2024 the index had increased by 1.3% on the year before, less than the long run average of 4.3% per annum. This is significantly less than the yearly increase of 10.4% measured in December 2022. The increase of construction costs have been caused by a range of factors, including:

- Material costs: The cost of building materials, such as timber, steel, and concrete, has risen significantly in recent years. This is partly due to increased demand for these materials, as well as disruptions to global supply chains caused by the COVID-19 pandemic.

- Labour costs: The cost of labour is also a significant factor in building costs. In New Zealand, there have been shortages of skilled construction workers, which has driven up labour costs.

- Building regulations: Changes to building regulations, such as the introduction of new earthquake standards and the requirement for higher levels of insulation, have also contributed to the increase in building costs.

- Increased demand: There has also been an increase in demand for new housing in New Zealand post-covid, particularly in Auckland and other major cities. This has led to increased competition for building materials and skilled labour.

What to consider when getting a replacement cost valuation

The replacement cost is the estimated amount required to rebuild or repair your home, including its fixtures and fittings, to the same condition it was before a loss occurred. A valuation will take into account the size, age, and location of your home, as well as any unique features or upgrades that may add to its value. The appraisal will also need to include labour costs, other professional services and GST.

Some of the key factors you should consider when calculating your home replacement cost include:

- The homes size: The first step in determining the replacement cost of your home is to calculate its size. Clearly, the larger the house the more expensive it will be to replace.

- The type of construction: The type of construction of your home will also impact the replacement cost. For example, homes constructed of brick, stone or concrete tend to cost more to rebuild than homes built of wood or vinyl.

- The quality of materials: The quality of materials used in your home also plays a significant role in determining the replacement cost. High-end finishes and materials will be more expensive to replace.

- Account for unique features: Unique features of your home, such as a custom-built fireplace or a tennis court, can also impact the replacement cost. Make sure to include the cost of replacing such features in your calculation.

- Include the cost of labour: The cost of labour is a significant factor in calculating the replacement cost of your home. Make sure to factor in the cost of hiring contractors, plumbers, electricians and other professionals.

- Council consent costs: The process of going through a council consent should be incorporated into the replacement valuation.

Obtaining a valuation

An online calculator is a good place to start and most insurers will have one. These calculators typically take into account the factors mentioned above and provide an estimate based on your location, square footage and other factors including professional fees, demolition and GST.

Below is an example of a valuation calculator, although you should contact your insurer for their version.

https://sumsure.corelogic.co.nz/#/products/8/profiles/222?partner=22202

For larger or more expensive houses, or houses in areas difficult to build, you might want to consider a valuation from a quantity surveyor or a registered valuer. These valuations will take into account the specific features and details of your property.

- A Registered Property Valuer will likely be able to provide you a valuation slightly cheaper than a quantity surveyor. They need to be certified annually by the Valuers Registration Board. A list of registered valuers can be found here: https://gazette.govt.nz/notice/id/2022-go3397

- The New Zealand Institute of Quantity Surveyors have a list available of surveyors who can help with residential reinstatement insurance valuations. These valuations are normally more detailed and useful if your estimate includes more complex situations such as difficult foundations or retaining walls. We can provide you names for someone in your area.

EQC Cover

Changes to EQC cover means they raised their cover from $150,000 to $300,000 of any eligible claim for residential buildings. This will also see an increase in the EQC levy to a maximum of $480 +GST. EQC does not cover your home for every natural disaster and it is recommended to have private insurance to ensure your home is adequately covered under any natural disaster and above the EQC maximum pay-out.

Summary

Once you have determined the replacement cost of your home, it is essential to select an insurance policy that offers the appropriate level of coverage. Home replacement insurance should cover the full cost of rebuilding your home, including labour and materials, as well as any additional costs associated with rebuilding, such as permits and fees. It is important to review your policy carefully to ensure that all potential expenses are included.

By working with an insurance provider to obtain a comprehensive policy that covers the full cost of rebuilding your home, you can ensure that your investment is protected and that you have the resources you need to recover from any unforeseen events.