In the 1800s, the American railroad industry was one of the boldest infrastructure projects the world had ever attempted. The expansion of rail lines opened the continent, transformed trade, and ignited extraordinary economic optimism. Yet behind the engineering marvels and frontier expansion lay a system overloaded with debt, speculation and corporate fraud.

Many companies grew too fast, borrowed too much, and ultimately collapsed, triggering some of the most severe financial crises of the century. The story of these failures sheds light on timeless investment lessons that remain highly relevant today.

The Rise of Railroads

Railways were viewed as the future of the American economy. Investors believed that laying track almost anywhere would deliver profits. After the US civil war, a boon in railroad construction saw over 50,000 kms of new railroad built in the following decade. Figure 1 illustrates the railroads built from 1860 to 1890 including the Northern Pacific Southern Pacific, Central Pacific and Union Pacific.

Capital flooded into the sector, often far ahead of actual population growth or freight demand. These new routes generated little revenue, and their construction was financed with heavy borrowing. The industry became both the backbone of U.S. commerce, a speculative bubble and the source of growing financial instability.

The Panic of 1873: The Long Depression

The Panic of 1873, now known as The Long Depression, was one of the most significant economic turning points of the 19th century and was directly tied to the railroad industry. It is often called “the first global depression”, as its effects reached across Europe and North America.

As with many great economic downturns there were a number of events that lead to the failure. This included a stock market crash in Europe and speculative investing in unproven assets such as railroads.

By the early 1870s, railroad construction had reached a speculative frenzy. Companies financed vast stretches of new track through debt, such as bonds or preference shares based off optimistic projections of future traffic. Investment banks, most notably Jay Cooke & Company, raised enormous sums to support this expansion and had significant exposure to railway bonds on their balance sheet.

In Europe, a stock market crash led many investors to sell their railroad bonds to generate cash. With the market saturated with sellers it soon became difficult to sell bonds. Jay Cooke & Co. had a significant holding in Northern Pacific Railway bonds which they were unable to sell. Although it is thought that Cooke asked President Ulysses Grant for a bailout, it was not forthcoming and the bank failed in September 1873. Investors lost their money and confidence in the railroad sector evaporated.

Figure 1: Railroad expansion from 1860 to 1890. Source: http://cprr.org/Museum/RR_Development.html

The economic fallout was significant as nearly 25% of all U.S. railroad companies went bankrupt and more than 18,000 businesses across America failed in the following years. With construction, manufacturing, farming and mining activity all being hit, unemployment eventually reached 14%. Labour unrest (driven largely by harsh wage cuts) grew, culminating in the Great Railroad Strike of 1877. This strike led to rioting across many states and national guard troops being deployed to regain order. Overall, the depression lasted 5 years, longer than the Great Depression of the 1930s.

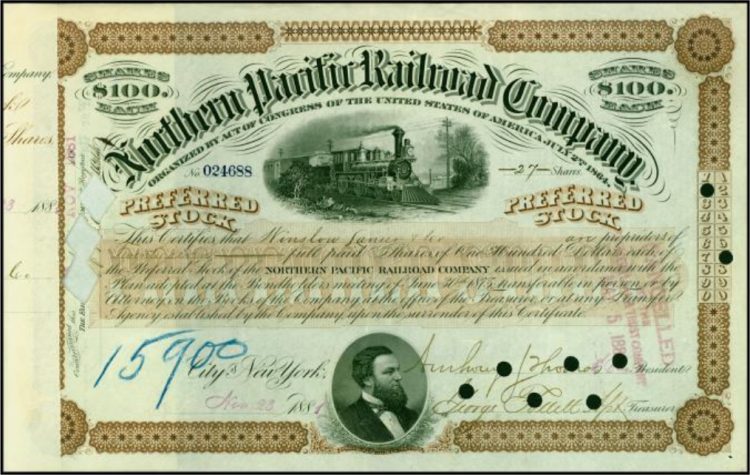

Figure 2: Example of a preference share in Northern Pacific Railroad

Source: https://en.wikipedia.org/wiki/Northern_Pacific_Railway

Why So Many Railroads Failed

Although corporate fraud and corruption were amongst the reasons for railway company collapses, there was also several interconnected reasons:

Overexpansion: Companies built far more track than demand justified at the time, with companies often operating on overlapping routes. Forecasting freight or passenger volume was somewhat speculative. For example, the Northern Pacific Railway would eventually connect Lake Superior to the mid-west and Puget Sound on the West Coast. However, when they went bankrupt the traffic on the line was described as “sparse”.

High leverage: Construction was funded almost entirely with borrowed money. This included a significant amount of money from European investors. As revenues fell short of expectation and refinancing rates increased, debt financing became more difficult. The ability to service debt and meet coupon payments declined as revenue failed or external credit conditions tightened.

High costs: Immigrant labourers were used to lay tracks but often they were building through territories which saw them in confrontation with Native Americans or were building in freezing winter conditions or through difficult geography such as swamps. All of these increased costs which were often underestimated significantly.

Figure 3: A cartoon of a giant figure named ‘Panic’ clearing garbage on Wall Street, 1873.

Source:https://www.federalreservehistory.org/essays/banking-panics-of-the-gilded-age

Why These Failures Still Matter

The Panic of 1873 exposed the fragile nature of speculative railway investments throughout the 1800s. The crisis demonstrated that even transformative industries can become dangerously over-leveraged. We are currently living through another period of powerful technological optimism, driven by artificial intelligence. AI promises remarkable gains in productivity, automation, and economic growth. Though the context is different today, the history of 19th-century railroads offers several parallels.

1. New technologies can create intense speculation

There are trillions of dollars being invested in building the infrastructure that will support artificial intelligence, including data centres, power networks, and new generations of consumer technology. Much like the railway boom of the 1800s, today’s AI expansion is being fuelled by a period of relatively easy credit and intense investor enthusiasm, with many eager to “get on board” the AI train.

2. Debt is a double-edged sword

Borrowing accelerates growth but can magnify losses when conditions shift. Investors, companies, and even households remain subject to this rule. Increasingly, AI investment is being funded through debt, with some businesses having limited or unproven revenue streams. The ability of these companies to service that debt while meaningful revenues may still be years away will be a critical factor in determining which firms remain solvent and which do not.

3. Diversification protects wealth

Investors heavily concentrated in railroads suffered catastrophic losses during the 1873 panic. Diversification to many different sectors is a proven buffer against sector-specific downturns and investing using fundamentals has been a successful long-term strategy.

Summary

The 19th-century U.S. railroad insolvencies arose from a confluence of substantial upfront cost, over‐expansion, demand shortfall, heavy debt, macro-shocks and refinancing risk.

Although railroads ultimately changed the world many investors still lost everything. In a similar manner, we know AI will be transformative, but we also know that not every AI investment will succeed. Good ideas can still be bad investments if timed poorly. Even though times have changed, the laws of financial gravity have not.